On Tuesday (April 7), the price of Ether, the world's most valuable digital asset (by market capitalization), jumped suddenly to $175.79, its highest level since March 12. , as Phase 0 - the first phase of the Serenity update (ETH2.0) is about to go live in July 2020.

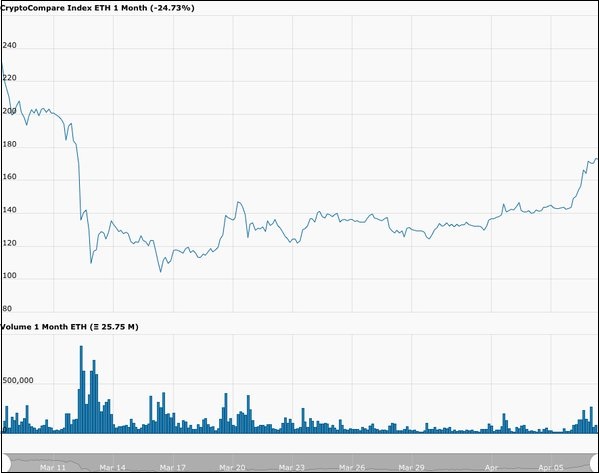

According to data from primexbt, at 00:20 UTC on April 7th, Ether price hit $175.79, as we can see on the ETH/USD monthly price chart below.

Ethereum price highest since March 12 thanks to positive reaction around ETH 2.0

ETHUSD monthly price chart

At the time of writing (10:05 UTC on 07/04), the ETH/USD pair is trading at $174.55.

Trading level at the time of writing

This means that so far in 2020, the price of the Ether crypto has increased by 35.40%.

It is also reasonable to say that part of the excitement around Ethereum is due to the ETH 2.0 (“Serenity”) upgrade, which Ethereum Foundation researchers hope to launch on July 30.

During an AMA ("Ask Me Anything") on Reddit on February 6 called the "Eth 2.0 Research Team AMA" opened by Danny Ryan and Justin Drake from the Ethereum Foundation, the team hoped waiting for ETH 2.0 to release before 30/07/2020, and believe that the plan will be implemented this year.

Regarding the expected date of ETH 2.0's Phase 0 launch, Drake said:

“I hope we can do it by 07/30/2020 (5th Anniversary Ethereum 1.0). Very unlikely to launch in Q1 or Q2 2020, especially as we need 3 clients (client data design): testing, testing and verification to prepare for the launch .”

And when asked if he would consider this a failure if Phase 0 doesn't come online in 2020, Drake replied:

“Yes, that would be a failure. I am 95% confident that we can launch in 2020 :)”

See more: Bitcoin is Forming a Bullish Divergence and a Reversal V

Ryan looks even more certain about the first phase rollout of 2020

“Phase 0 will definitely be rolled out in 2020. The audit is done and the testnets are getting stronger week by week. The evaluations are based on spec (operating manual) and clients - which have been (relatively) good feedback on a third-party audit report. The rest depends on technical issues and stabilization/maximization in the final stages."

“I cannot imagine a reality without Phase 0 in 2020.”

Damien Brener, founder and CEO of OpenZeppelin, the security audit unit for Ethereum, said:

“From a developer’s perspective, Ethereum is a popular Blockchain platform with smart contracts and efficient Dapps.”

“People are realizing that the effect of the Ethereum network is stronger than they thought, especially in the community and in its composability, which increases trust. into the platform and thereby bring in higher prices.”

As for Jehan Chu, founder of Kenetic Trading Limited in Hong Kong, he made his point:

“Ethereum will continue to be the second largest coin, and the recent rally shows traders’ long-term confidence in its position in the market.”

“Besides the price, how Ethereum is heading towards ETH 2.0 and solving the problems of network speed and scale is also a story worth watching. In today's environment, we have to fight for survival, and no protocol or group of developers has ever maintained this high level better than Ethereum."

Yesterday (April 6), Santiment, a crypto startup specializing in behavioral analysis, said that the recent price action of Ether shows that the active Ethereum addresses of the day is a useful metric for forecasting. predict future price movements of Ether.

Comments

Post a Comment